USDC, Bitcoin Cashback, and MiCA Compliance: Coinbase’s Roadmap to Becoming the PayPal of Web3

Coinbase, once known simply as a crypto exchange, is now crafting a financial superapp that stretches far beyond token trading. With a string of strategic launches – ranging from stablecoin integrations and cashback cards to compliance victories in Europe – Coinbase is rapidly evolving into the PayPal of Web3.

From merchants to developers, and from freelancers to enterprises, the platform is stitching together a seamless financial experience grounded in crypto – but accessible to everyone.

Let’s break down what’s powering Coinbase’s next era.

USDC Payments on Base: Crypto Checkout for the Masses

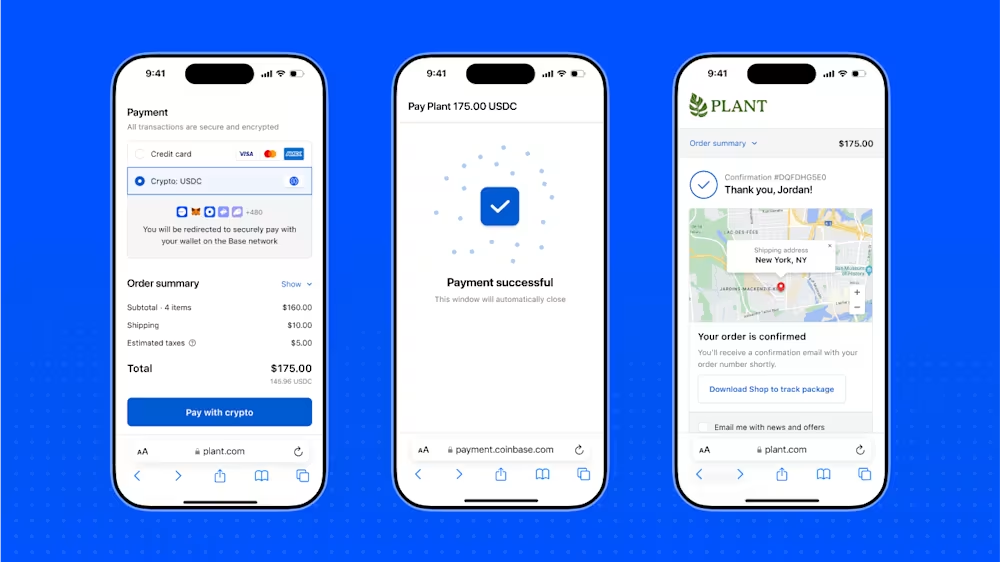

In partnership with Shopify, Coinbase recently unlocked a game-changing solution: USDC payments via Base, its Layer-2 blockchain. This update means millions of merchants globally can now accept stablecoin payments without the volatility or gas fee headaches that once plagued crypto commerce.

The integration leverages Coinbase Commerce and its updated checkout flow that feels more Web2 than Web3 – streamlined, user-friendly, and built for scale. Merchants receive payments in USDC, instantly settled and free from blockchain friction.

This isn’t just a win for Shopify merchants – it’s a step toward mainstream crypto acceptance across ecommerce.

The Coinbase One Card: Bitcoin Back on Everything

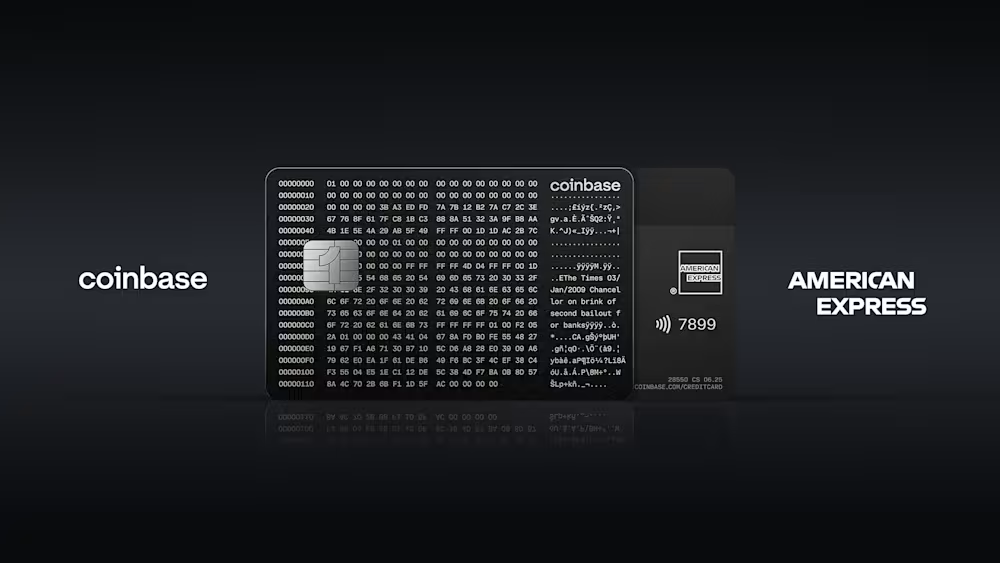

Imagine earning up to 4% back in Bitcoin every time you grab a coffee, book a flight, or pay your phone bill. That’s now a reality with the new Coinbase One Card, launched as part of its premium subscription tier.

Tied to Mastercard’s global infrastructure, the card allows users to spend directly from their crypto balance while earning rewards in BTC. It’s a powerful way to make crypto spending feel rewarding – and habitual.

This is Coinbase’s answer to the fintech arms race: if banks and neobanks offer points, Coinbase offers programmable money.

Coinbase Business: A Finance Stack for Web3-First Companies

Not all innovation is consumer-facing. With Coinbase Business, the platform introduces a full-stack solution for companies building in crypto – or simply accepting it. Features include:

- Fiat and crypto treasury tools

- Automated payment flows

- Multi-user access and roles

- Real-time reporting and compliance-friendly structures

From DAOs managing multi-sig wallets to startups sending USDC payroll globally, Coinbase is creating an operating system for modern finance.

MiCA License Secured: A Foothold in Europe’s Crypto Future

Europe is setting the regulatory pace for crypto globally – and Coinbase just secured a MiCA license, making it one of the first movers to operate under the EU’s new crypto framework.

This not only enables Coinbase to offer services across all EU member states with a unified license, but it also reinforces trust and stability in a space often criticized for regulatory grey zones.

Coinbase’s compliance-first approach positions it as a safe harbor for European users and institutions navigating a still-uncertain global crypto landscape.

Why This Matters: The Rise of the Web3 Financial Layer

Coinbase isn’t building features – it’s laying the rails for a future where crypto finance feels as seamless as using PayPal or Apple Pay.

And unlike PayPal, Coinbase’s products are:

- Multichain and interoperable

- Permissionless at the core

- Built around programmable money

With stablecoin rails for merchants, Bitcoin rewards for users, treasury tools for businesses, and regulatory greenlights in major markets, Coinbase is not just keeping up with Web2 fintech – it’s outgrowing it.

Final Thoughts

The road to mass adoption isn’t paved by speculation. It’s built by companies solving real problems with real products. Coinbase’s recent moves show a deep understanding of this reality – and a firm commitment to leading the Web3 charge with clarity, credibility, and convenience.

If PayPal helped digitize payments in Web2, Coinbase is on track to decentralize and democratize finance in Web3.